For the last twelve months, the province’s Ministry of Justice, led by Minister of Justice and

Deputy House Leader Mickey Amery, has been breaking down an announcement made by the

federal government in October 2023, which gave homeowners who heat with heating oil, a

break on the carbon tax.

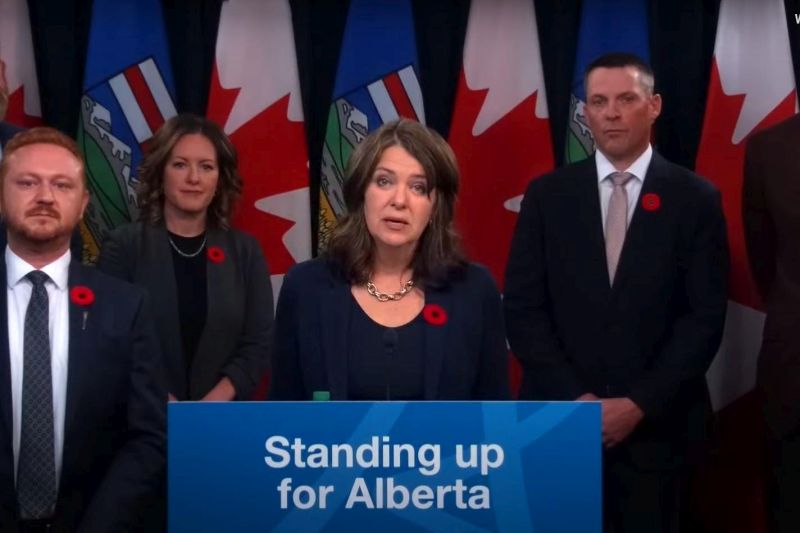

Their question was, is a deal on the carbon tax lawful and constitutional? Last week, Albertans

found out the answer. In a press conference on Tuesday last week, Premier Danielle Smith and

Minister Amery laid out the issue, explaining why they felt it was important for the province to

head back to court against Ottawa.

Premier Smith said that the “punishment” of the carbon tax had, until recently, been shared

equally across the country. “At the very least, that equal footing gave Canadians a unified front

to push back on the federal government. A sense, maybe, that we were all in it together. But a

year ago, almost to the day, Ottawa announced it was exempting heating oil from the federal

carbon tax for three years,” she stated.

Premier Smith said she wasn’t resentful of the break given to those who use heating oil but felt it

put some Canadians at a disadvantage, specifically those who use anything but heating oil.

“Unfortunately, this exemption applies to practically no one outside of Eastern Canada. Less

than one percent of Alberta, Saskatchewan and Manitoba use home heating oil. It’s one percent

in British Columbia, two percent in Ontario, four percent in Quebec, seven percent in New

Brunswick, 18 percent in Newfoundland and Labrador, 32 percent in Nova Scotia and 40

percent in Prince Edward Island,” she rounded off.

Across Canada, the energy use database from Natural Resources Canada shows that about 1.2

million homes use heating oil, and the percentages listed above show that most of those

residences are in the East, with nearly one in three homes in the four Atlantic provinces using it.

It’s also more expensive as it can cost four times as much to generate the same amount of heat

using oil versus natural gas.

When the three-year reprieve was announced last year, PM Trudeau said it was to allow

residents time to switch to heat pumps. The pumps and installation could be free or paid

through an interest-free loan, income-dependent. He said the savings made on electricity use

would pay the loan back.

Around the same time, the Conservatives put forward a non-binding motion to remove the

carbon tax from all home heating fuels, which did not pass. Liberal MPs from Atlantic Canada

have supported similar motions, including MP Ken McDonald of Newfoundland and Labrador,

who has supported previous motions to repeal the carbon tax.

“Home heating is not optional. Winter is coming again, and that means that Alberta families will

again, feel the sting of the federal carbon tax as they heat their home with natural gas. Here in

Alberta, we don’t tend to think that more taxes are the solution for anything, let alone a tax on

everything our citizens need to live and thrive in this cold climate,” said Premier Smith during the

press conference.

“We can debate why Ottawa made this decision. We may even have a few theories, but

whatever their reasons, the outcome is blatantly unfair for people in Alberta and other parts of

Canada who use natural gas and other fuels to stay warm in the winter. From where we’re

sitting, it looks an awful lot like one more attempt to divide our country, to reward one region and

punish another.”

Earlier that morning, on Tuesday, October 29, Alberta officially applied for a judicial review of the

exemption in federal court. “We’re asking the court to declare the exemption both

unconstitutional and unlawful. We hope this will force Ottawa to recognize the burden carbon

tax places on Canadians and eliminate the tax altogether,” added Smith.

“According to their own communications, the exemption was intended to lower energy bills for

people who use heating oil. They’re saying in effect, that some Canadians deserve lower energy

bills, but not all. They are also more or less admitting that the federal carbon tax raises costs for

households, which confirms what we’ve been saying about it all along.”

Minister Amery said they expected the review to take about twelve months and said they felt

they had a strong case. He also said that giving a break on heating oil felt counter to the idea of

the carbon tax, given it’s one of the highest emitting fuels. “You would think the federal

government would reward that type of use (natural gas) by providing this exemption to Albertans

and Western Canada. We know that natural gas burns cleaner, is more efficient, more

environmentally conscious, and it’s not being recognized in any way.”

Premier Smith said the break also undermines the federal government’s entire argument. “The

entire argument that the federal government made about why they needed to impose a federal

retail carbon tax was to create fairness across the country. This clearly does not create fairness,

and it exempts one of the highest-emitting fuels. I think it’s pretty clear that there are certain

regions in the country that are disproportionately benefiting from this.”

When asked why she thought the federal government decided to offer the discount in the first

place, Premier Smith said, “I certainly hope they wouldn’t be playing politics with something as

important as home heating in the middle of winter in Canada. But the fact of the matter is that

they have brought forward an exemption that violates their own law, and we believe it violates

the constitution, and we’ll see if the courts agree.”

More Stories

Community spirit shines at large-scale youth baseball event

Birthday party chaos sung beautifully by Pumpjack Players’ youth in spring musical

Gearing up for another season of cars, cruising and camaraderie